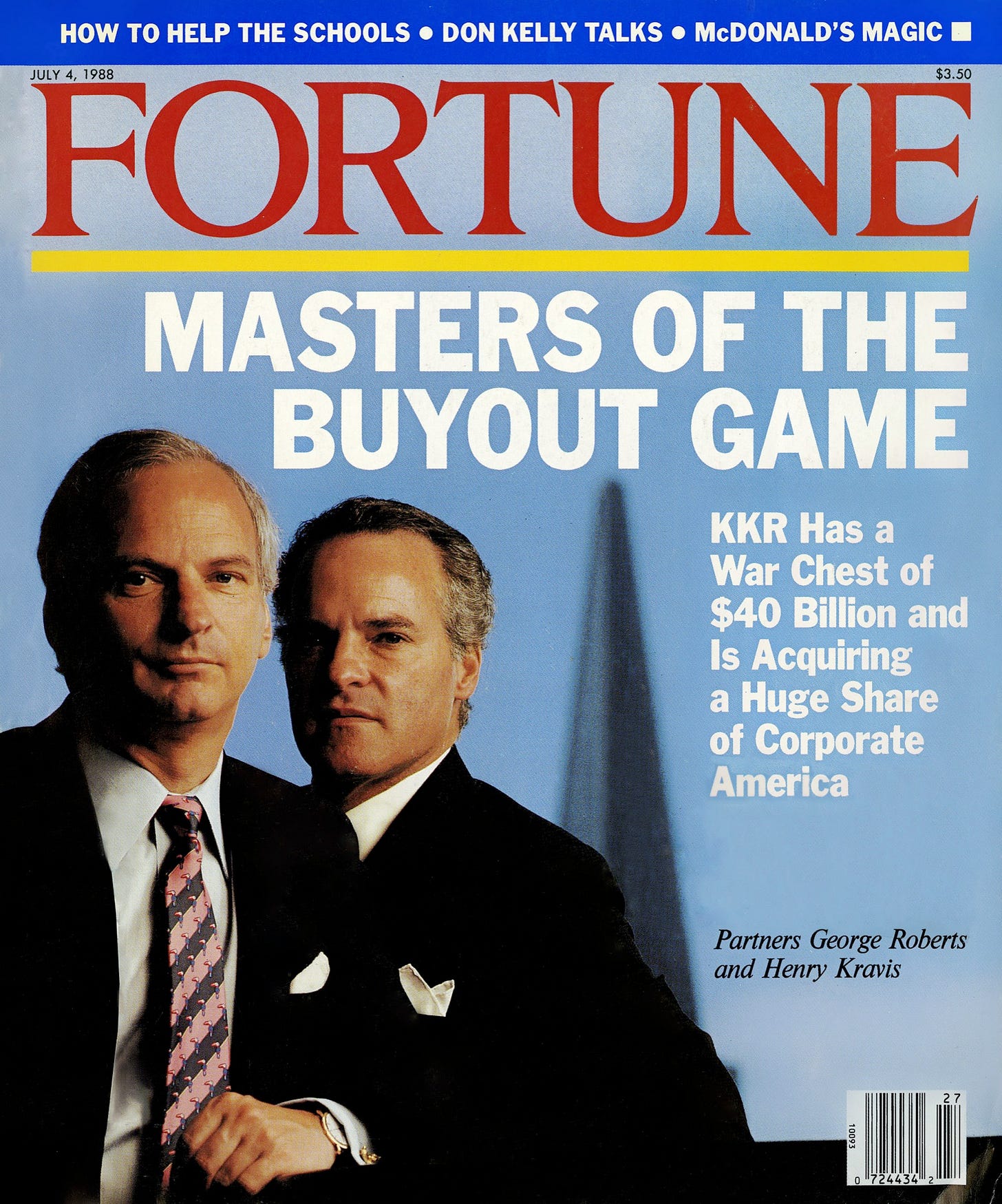

Wall Street has famously been a place for young and ambitious people looking to make a career in finance, and has been host to numerous boom and bust phases, whether it be the IPO craze of the late 90s or the mortgage derivative boom in the 2000s. In the 1980s, leveraged buyout (LBO) firms like KKR spearheaded the then largest takeover deal ever in the purchase of RJR Nabisco, as chronicled by the bestselling book ‘Barbarians at the Gate’. As these types of takeovers typically involved large amounts of debt and cost cutting layoffs to pay for the debt, LBOs grew unpopular by the 1990s, eventually leading to the industry rebranding under the Private Equity banner. But despite the name change, cheap interest rates following the 2008 financial crisis led to a massive rise in funds of private equity management by over 1,000 times today over 1980, with perhaps a trillion dollars controlled by the top 30 firms of the likes of Blackstone, KKR, and the Carlyle Group. Tonight we are joined by New Yorker Ace Neiderhoff to give us an insider take on this often misunderstood but tremendously significant industry, and also offer guidance to those seeking to make it in one of the toughest and most competitive cities in the world.

-- Brought to you by --

Very special guest Ace Niederhoff

https://x.com/aceniederhoff

stay tuned for the ‘Manifest Destiny Podcast’

with Adam Smith and Hans Lander

--

New: Hard Copies of Exit Strategy now Available! http://www.lulu.com/shop/adam-smith/exit-strategy/paperback/product-24191334.html

- http://myth20c.com

~~-- Donations --~~

Ethereum: 0x4d3617C1C5b466E2BE1aD1F7D85C03DBBa6F6bb7

BTC: 16UQ6ukmTjz4Z7Ce4n23bN6tKGnU7XkPeQ

- https://myth20c.wordpress.com/books/

- http://theamericansun.com

- http://twitter.com/myth20c

- myth20c@tutanota.com

- http://gab.ai/myth20c

-- References --

- Intelligent Investor, Graham (1949)

- Barbarians as the Gate, Burrough (1989)

- Investment Banking: Valuation, Leveraged Buyouts, and Mergers and Acquisitions, 2nd Edition, Rosenbaum et. al. (2013) - https://a.co/d/iIY95mD

- Big Short, McKay (2015)

- The Secretive Industry Devouring the U.S. Economy, Karma (2023) - https://www.theatlantic.com/ideas/archive/2023/10/private-equity-publicly-traded-companies/675788/

- Private Equity 2023 Year-in-Review and 2024 Outlook: Clearer Skies Emerge for Private Equity Amidst Challenges, Cherry Bekaert (2023) - https://www.cbh.com/guide/reports/private-equity-industry-report-2023-trends-and-2024-outlook/

- Nobel Laureate Romer Says AI Hype Risks Repeat of Crypto Bubble, Savov (2024) - https://www.msn.com/en-us/money/markets/nobel-laureate-romer-says-ai-hype-risks-repeat-of-crypto-bubble/ar-BB1neec0

- 2023-2024 Best Business Schools - The Princeton Review - https://www.princetonreview.com/business-school-rankings/best-business-schools

- Wall Street Oasis - https://www.wallstreetoasis.com/

Share this post